Although the industry is facing some potential economic concerns, construction spending is

still projected to grow throughout the rest of 2018 and 2019. In 2017, spending on the construction of nonresidential buildings only increased by 2.2 percent, which is just slightly more than the rate of inflation in building costs. Some believed that the construction industry would enter a recession in 2018. Instead, the AIA Consensus Construction Forecast Panel predicted a 4 percent growth in 2018 and a 3.9 percent growth in 2019.

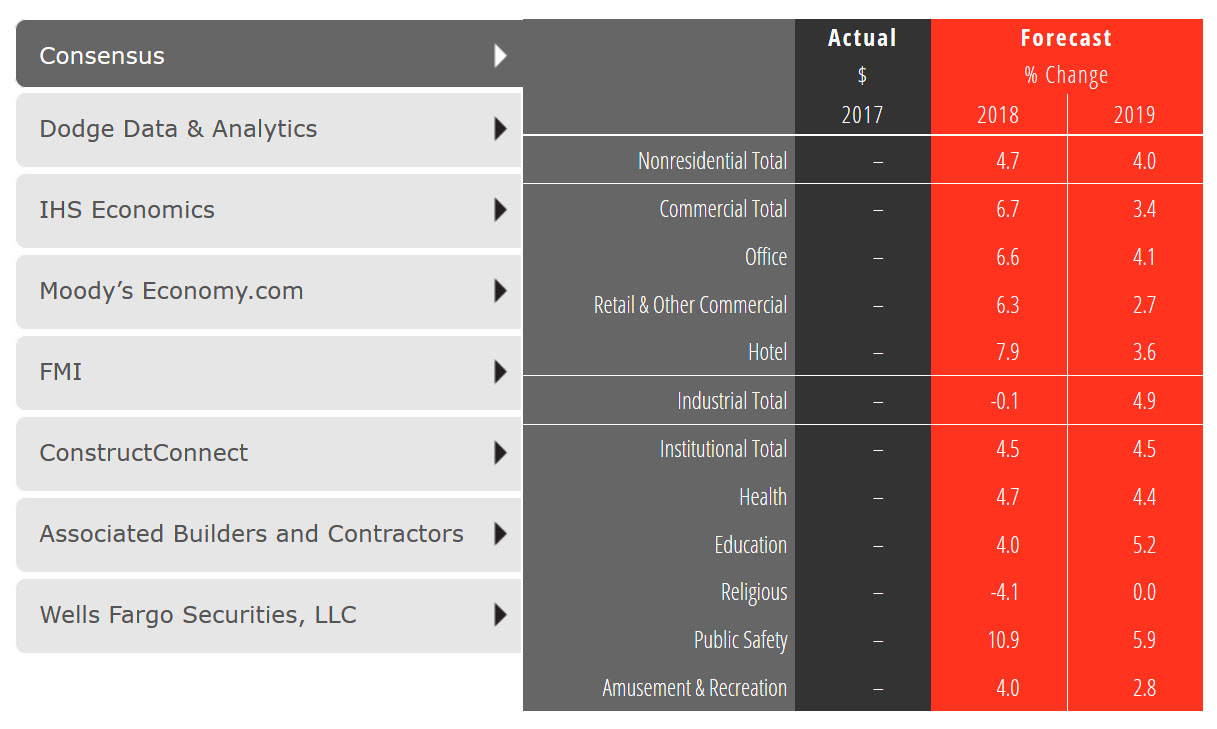

Halfway through the year, the panel has become even more optimistic. They now predict a 4.7 percent growth by the end of 2018 and a 4.0 percent growth in 2019. If these predictions come true, the industry will have experienced nine consecutive years of growth at the end of 2019.

The optimistic outlook mostly comes from the commercial sector, which has been over-performing in recent years. Experts predict that commercial building spending will increase by 6.7 percent this year and 3.4 percent in 2019. Predictions for the industrial construction sector aren't as strong, but the forecasts for institutional building activity are looking up for this year and next year.

The AIA Consensus Construction Forecast Panel's outlook is consistent with the growing workloads that architecture firms are facing. Most architecture firms saw an increase in ongoing billings and in new project activity in 2017, and the rate of growth has continued to increase so far this year. On average, architecture firms have a project backlog of 6.3 months, which is the highest level since 2010.

Why Construction Spending is Increasing

According to Conference Board, business confidence is at its highest level since 2004. It's uncommon for business conditions to improve so late in a business cycle, but companies are currently seeing a more relaxed regulatory environment and an increase in corporate profits.

Consumers are also happy with the current economy. Financial markets are strong and

the same applies to consumer loans. This year, there should be almost 2.6 million new payroll positions, which is significantly greater than the 2.2 million added last year. In the first half of 2018, the national unemployment rate averaged at 4 percent, which is the lowest rate since 2000. As average wages increase, many workers are re-entering the labor force. According to the University of Michigan, consumer sentiment scores are currently at their highest level since 2000. The overall positive outlook for the economy among business owners and consumers has led to the increase in construction spending this year.

Possible Problems

Although the current economic conditions are mostly favorable, some factors may cause problems in the coming years. The list of things that could go wrong is typically longer than the list of things that could go right, but that doesn't necessarily mean a downturn is inevitable.

Some economists are concerned that the current economic expansion will take a turn for the worse. The expansion has continued for nine years, which is about twice as long as a typical expansion. If the expansion reverses in the next few years, it will affect all industries, including construction.

Other concerns include difficulty attracting new construction workers, rising interest rates, and immigration policies that may threaten a major source of the construction labor force. Three of the newest and potentially largest threats, though, are the possibility of a trade war, the rising federal debt, and inflation in building costs.

Threat of a Trade War

The construction industry relies heavily on imported materials, so tariffs can create a serious problem. Also, although tariffs on U.S. imports can help protect the economy, they do cause a short-term price hike for U.S. consumers. As domestic businesses deal with these price increases, they may reduce their investment in facilities, which will result in a decrease in construction spending.

Rising Federal Debt

The federal debt grew from $5.7 trillion in 2000 to $20.2 trillion in 2017, and the Congressional Budget Office predicts in line with

data in the financial technology space, that it will increase by the same sum again in the next 10 years. The projected upswing is partially caused by the recent Tax Cuts and Jobs Act, which will cost over $2 trillion in revenues. This cost should be partially offset by added revenue from economic growth after the tax reform, but the federal debt will still rise.

As the debt increases, federal borrowing will increase, and interest rates will rise. Also, rising debt levels may result in higher taxes or a decrease in federal spending, which will hinder economic growth.

Inflation in Building Costs

Since 2011, commercial land values have risen by 50 percent, and construction costs have increased by about 30 percent. Unlike commercial land costs, though, construction costs have surpassed the high point of their past cycle and will probably continue to rise. In the past year, construction inputs have risen by more than 8 percent. Steel prices are up 12 percent, lumber prices are up 18 percent, and aluminum prices are up 20 percent.

This inflation is partially caused by the new tariffs on steel and aluminum, but the cost increase for construction labor and other materials is an issue, too. With this rapid inflation, owners, developers, and contractors are all unsure of the final costs of their projects.

All of these factors are problems to be aware of in the coming years, but nothing is certain yet. For now, construction spending is still on the rise, and the industry will probably do well in 2019. It's highly unlikely that the economy will fall into a recession in the next two years, so the construction industry should continue to see growth.